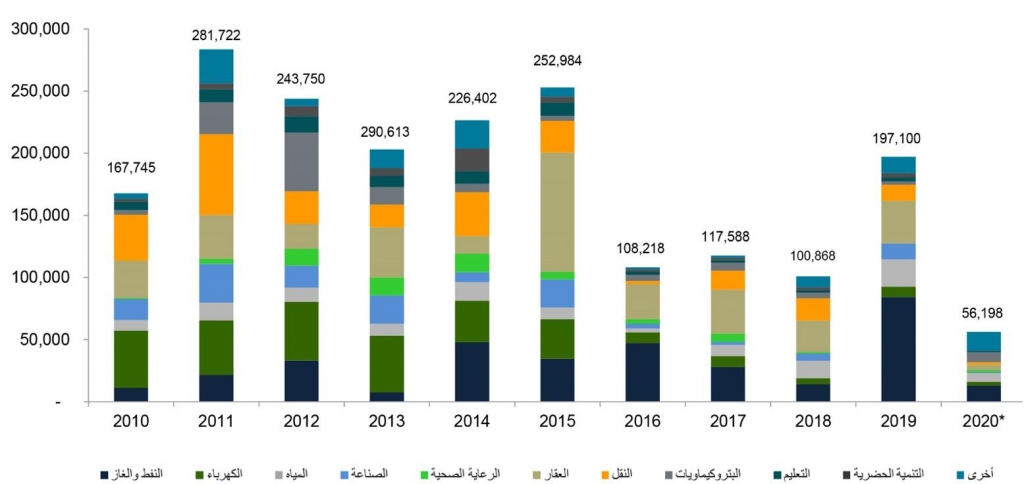

Value of Awarded Contracts Set to Rebound in Second Half of 2020

The value of awarded contracts in the Kingdom decreased during the second quarter to SAR11 billion ($2.9 billion) after a strong showing during the first quarter, according to a report by the U.S.-Saudi Business Council (USSBC). The promising start to the year fizzled during Q2 as numerous project awards were suspended due to the effects of the coronavirus pandemic. Furthermore, many of the projects that were in initial phases of execution were halted as stay at home orders, redirecting some of the government’s budget, and significant declines in the revenues of construction companies paused spending plans and initiated reorganization strategies to accommodate these drastic market changes. The brunt of the impact was expected to occur during the second quarter as the initial challenges surfaced in March, which led the government to spend approximately SAR270 billion to accommodate the private sector. Consequently, the value of awarded contracts declined by SAR54 billon ($14.4 billion) during Q2’20 compared to last year, and declined by SAR34 billion ($9.1 billion) compared to last quarter. Through H1’20, the total value of awarded contract reached SAR56.2 billion ($11 billion), a decline of SAR57.8 billion ($15.4 billion) compared to H1’19.

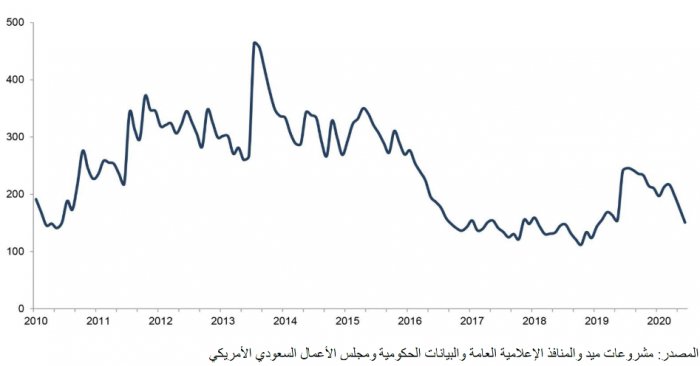

USSBC’s Contract Awards Index Performance Through Q2 2020

The USSBC Contract Awards Index (CAI) reached 150.81 points at the end of the second quarter. This reflects a decrease of 65.79 points compared to the first quarter as the value of awarded contracts precipitously declined during the second quarter. The CAI ended at 197.51 in April, 174.63 in May, and 150.81 in June. The CAI’s performance compared to H1’19 reflected an 89.63 point decrease, highlighting the pace of awarded contracts that were witnessed in 2019.The strong showing during the first quarter lifted the CAI above the 100 point mark but will be tested in the coming quarters as contracts are still expected to be suspended or cancelled.

Overview of Awarded Contracts By Region During Q2 2020

The Eastern Province accounted for the highest share of awarded contracts during Q2’20 with SAR8.2 billion ($2.2 billion) or 75 percent of the total. The water and oil & gas sectors contributed the highest value of awarded contracts in the Eastern Province, accounting for SAR6.1 billion ($1.6 billion), or 74 percent of all projects. The projects included water desalination projects as well as work in the Marjan fields. Other contributing sectors included transportation, real estate, and industrial. Through H1’20 the Eastern Province has overwhelmingly led all other provinces with SAR30 billion ($8 billion) or 54 percent in awarded contracts.

The Makkah region garnered a distant second by value of awarded contracts with SAR1.2 billion ($307 million) or 10 percent. The power and real estate sectors were the lone contributors to the Makkah region as they involved the construction of an electric substation and a mixed-use development in Jeddah. Thus far through H1’20, the Makkah region has attracted SAR3.2 billion ($842 million) or 6 percent of the total awarded contracts.

The Riyadh region came in third place with SAR707 million ($188.5 million) as the healthcare and real estate sectors were the lone contributors. The projects include the construction of a six-story hospital and a large development by the Diriyah Gate Development Authority. The Riyadh region’s total value of awarded contracts through H1’20 accounted for SAR17.3 billion ($4.6 billion) or 31 percent.

Breakdown of Awarded Contracts Across Top Performing Sectors

Water

The water sector’s SAR4.3 billion ($1.2 billion) during Q1’20 led all other sectors although only two contracts were awarded. The water sector grew by SAR1.5 billion or 53 percent compared to last quarter, which witnessed SAR 2.8 billion ($752 million) in awarded contracts. However, the water sector registered a decline in awarded contracts in H1’20 of SAR6.4 billion ($1.7 billion) compared to the same period last year.

Oil & Gas

The oil & gas sector witnessed significant declines in contract awards during Q2’20 compared to last year. The SAR1.8 billion ($475 million) in awarded contracts this quarter reflects the impact of COVID-19 as well as the decrease in oil prices has had on Saudi Aramco’s project plans for 2020. Prior to the downturn, the oil & gas sector generated SAR11.2 billion (3 billion) in awarded contracts during Q1’20, which was on par with the prior year of SAR11.8 billion ($3.1 billion). Even more detrimental was the performance through H1’20, which yielded only SAR13 billion ($3.5 billion) compared to SAR60.2 billion ($16 billion) in the prior year. The numerous project holds by Saudi Aramco during Q2’20 will increase the pipeline of awarded contracts into the remainder of 2020 and into 2021, once they are resumed.

Real Estate

The real estate sector’s SAR1.7 billion ($440 million) in awarded contracts rounded out the top three sectors during Q2’20. The real estate sector witnessed declines as a number of project awards were delayed. Consequently, the value of awarded contracts declined by SAR3.8 billion ($1 billion) in Q1’20 compared to last year. Furthermore, the value of awarded contracts through H1’20 also witnessed declines as the value decreased by SAR5.7 billion ($1.5 billion) compared to the same period last year.

Healthcare

There was one notable contract in the healthcare sector involving the construction of a hospital in Riyadh. The Royal Commission for Riyadh City awarded the contract to the local International Hospitals Construction Company in the amount of SAR675 million ($180 million).

Contract Awards Outlook

The decline in awarded contracts during Q2’20 was anticipated as stay at home orders and significant budgetary adjustments by the government and private sector were dictated by the coronavirus pandemic. The recent release of the Kingdom’s Q2 budgetary report illustrates the impact COVID-19 and lower oil prices had on revenues, which resulted in a deficit of SAR109 billion ($29.1 billion). Furthermore, the redirecting of state expenditures impacted the allocation of capital expenditure projects. Capital expenditures have fallen by 52 percent during Q2’20 and by 36 percent during H1’20 compared to last year. The impact of the pandemic also affected the Economic Resources expenditures category, which decreased by 43 percent in H1’20 compared to the prior year. This category contains infrastructure related projects such as environmental works, water, agriculture, energy and mineral wealth, and tourism projects.

“Construction activities are expected to recover in the coming months after a tough second quarter”, commented Albara’a Alwazir, Economist at the U.S.-Saudi Business Council. “The remainder of 2020 will still be challenging but construction activity has already picked up slightly as the number of coronavirus cases in the Kingdom decline and the recovery of oil prices continues. A number of positive developments are underway that include the continued development of the Kingdom’s residential real estate sector.”

In order to achieve one of Vision 2030’s most important objectives of a 70 percent homeownership rate, the Ministry of Housing continues to construct housing units at an historic pace. The “Sakani” program plans to construct 100,000 housing units in 2020 and this will drive the growth of the construction sector. The Public Investment Fund’s recent establishment of “Roshn” is expected to attract more private sector involvement while lessening the burden on government resources to allocate housing to citizens.

Another positive sign is the resurgence of cement sales. Total cement sales of the 17 local producers jumped by 38 percent in August compared to the same period last year. Domestic sales increased by 41 percent. Furthermore, the National Cement Committee expects the cement sales to be buoyed by the residential real estate sector and witness steady demand for the remainder of 2020.

Looking ahead, there are a number of projects on the horizon that should drive construction activities for the remainder of 2020. These projects include the construction of the public facilities phase of the Qiddiya Project, the Red Sea Tourism airport packages, and Saudi Aramco oil & gas related projects.