The Gulf Bond and Sukuk Association Launches Oman Working Group in cooperation with BankDhofar

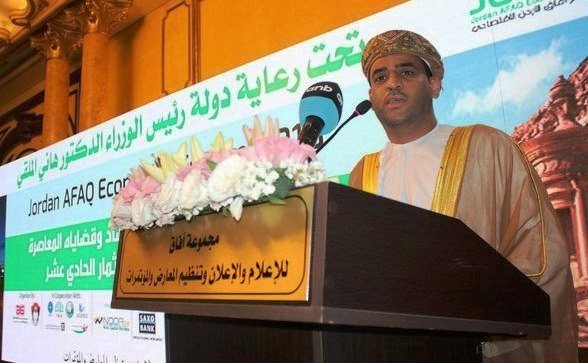

The Gulf Bond and Sukuk Association (GBSA) in partnership with BankDhofar has launched an industry working group in the Sultanate of Oman. The launch took place at a roundtable in Grand Hyatt Muscat and was attended by senior government officials and representatives of Oman’s leading banks, investors, legal firms and private companies. His Excellency Abdullah bin Salem Al Salmi, Executive President of the Capital Market Authority (CMA) delivered the keynote address.

The GBSA Oman roundtables and seminars, consisting of key market participants, will act as a resource for the Omani authorities to help grow the Oman market. The launch of the initiative was timed to follow the release of the new Sukuk Regulation by the Oman CMA for any Sukuk issuances, and to support the growing interest among Oman companies to tap into capital market financing.

His Excellency Abdullah bin Salem Al Salmi, Executive President of the Capital Market Authority, said: “The CMA fully supports this initiative taken by the market players, as a vibrant fixed income market is essential to the development, financial stability and diversification of the regional economy, including Oman. This is also an integral part of the overall strategy of the CMA to enable the capital market to play its vital role as an alternative fundraising platform for companies in the economic development of Oman.”

Abdul Hakeem Omar Al Ojaili, Acting Chief Executive Officer of BankDhofar, said: “BankDhofar is proud to support this initiative. An increasing number of companies are taking advantage of bond and Sukuk markets to extend their liability profiles and diversify their investor bases. The new Sukuk Regulation provides more certainty and improves the prospects for companies to fund in the capital market.”

The President of the GBSA, Michael Grifferty, said: “We are delighted to offer a platform that assists the growth of the Oman market,” adding “the market benefits from having such an active and engaged regulator as the CMA.”

The GBSA’s working groups and National Chapters bring together the thought leaders of the regional credit markets to create a more collective voice on key issues affecting the industry.