NBAD Sukuk Income Fund Delivers 2.57% Dividend Semi-annualised

The National Bank of Abu Dhabi’s NBAD Sukuk Income Fund has earned dividend income equivalent to USD 716,081.76 which equates to an annualized yield of 5.20% during the period from 19th November, 2015 to 9th June, 2016.

Eligible investors who had successfully subscribed to the Fund by 8th June, 2016 were entitled for a semi-annual dividend distribution which equals to 2.57% of the net asset value (NAV) of the fund as at 9th June, 2016. Accordingly, each unit in the Fund will receive a dividend pay-out of USD 0.1261.

The dividend payout will be based on the payout preference selected by the investor at the time of subscription. For those who selected the re-investment option, the dividends will be reinvested on 16th June, 2016 and for those who have selected the cash payout option, the proceeds will be credited into their NBAD bank account by the 27th June, 2016.

Ian Clarke, Head of Fixed Income at NBAD Global Asset Management, said: “Sukuk in the GCC and further afield have traded well in recent months in line with rising oil prices, following a few weaker months after the last dividend at the end of 2015. Growth rates and forecast growth rates in the region are stable with a host of policy measures working their way through the system to improve governments fiscal positons. These measures underpin the continued strength of the sukuk issuers and add to the appeal of the attractive profit rates still offered by regional sukuk. Against this background we are pleased to be able to distribute this healthy dividend on the Fund.”

NBAD’s Global Asset Management manages assets in excess of AED8.34 billion, making it one of the largest of its kind in the UAE.

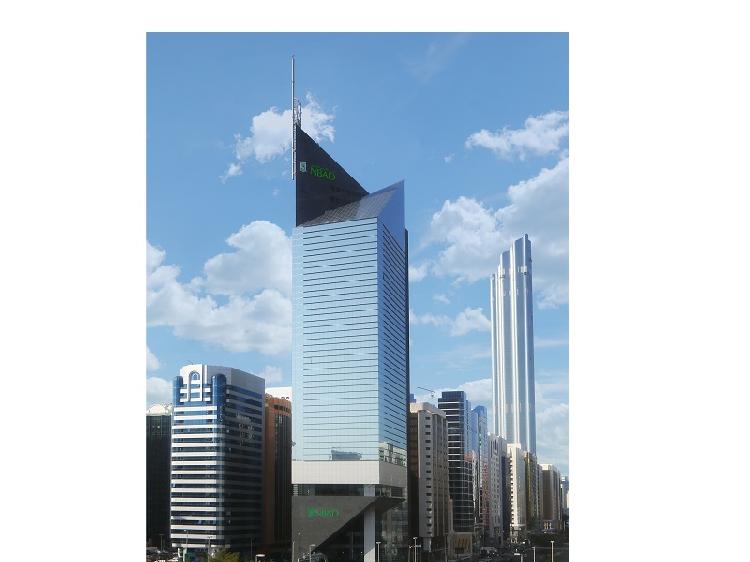

About NBAD

NBAD has one of the largest networks in the UAE, with 110 branches and cash offices and more than 550 ATMs across the country. NBAD’s growing international presence consists of 47 branches and offices in 17 countries stretching across five continents from the Far East to the Americas, giving it the largest global network among all UAE banks.

Since 2009, NBAD has been ranked consecutively as one of the World’s 50 Safest Banks by the prestigious Global Finance magazine, which also named NBAD the Safest Bank in the Emerging Markets and the Middle East.

NBAD is rated senior long term/short term AA-/A-1+ by Standard & Poor's (S&P), Aa3/P1 by Moody’s, AA-/F1+ by Fitch, A+ by Rating and Investment Information Inc (R&I) Japan, and AAA by RAM (Malaysia) , giving it one of the strongest combined rating of any Global financial institution.

A comprehensive financial institution, NBAD offers a range of banking services including retail, investment and Islamic banking. NBAD grows strategically toward its vision to be recognised as the World’s Best Arab Bank.

For more information please visit website: www.nbad.com