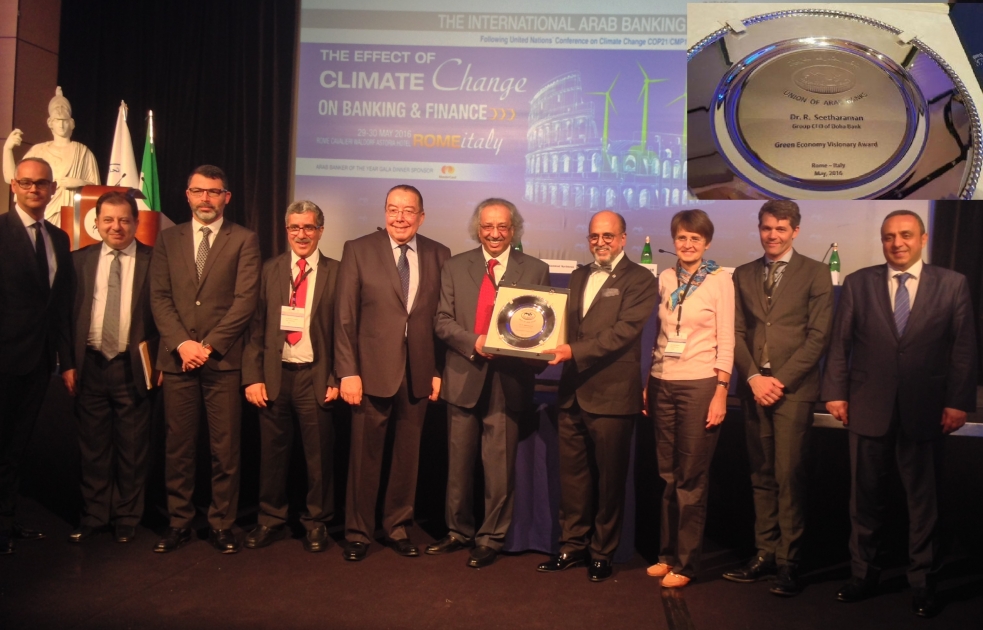

DOHA BANK CEO HONOURED WITH “GREEN ECONOMY VISIONARY AWARD” AT UAB SUMMIT

The 2016 Union of Arab Banks (UAB) International Banking Summit was held under the Auspices of the Prime Minister of Italy H.E Mr. Matteo Renzi on May 29- 30, 2016 at Rome Cavalieri Waldorf Astoria Hotel Rome – Italy. Dr. R. Seetharaman, CEO of Doha Bank was honoured with the “Green Economy Visionary Award” at the Summit on 30th May 2016. He received the award from Mr. Mohammed Jarrah Al-Sabah, Chairman, Union of Arab Banks in the presence of Mr. Wissam H. Fattouh, Secretary General Union of Arab Banks, H.E. Mr. Mohammad Machnouk, Minister of Environment, Lebanon, Mr. Sarkis Yoghourtdjian, Advisor, Federal Reserve Board, Washington DC, Mr. Mustapha Bakkoury, President du Directoire, MASEN, Morocco Mrs. Michele Caparello, Advisor to the Executive Board, European Central Bank, Mrs. Michele Caparello, Advisor to the Executive Board, European Central Bank and Mr. Eric Usher, acting Head of the United Nations Environment Programme Finance Initiative (UNEP-FI), Switzerland. The award was given for his outstanding contribution close to two decades towards environment friendly activities and thereby promoted Green economies. He was a recipient of multiple doctorates including the Ph.D. Degree on “Green Banking and Sustainability” from Sri Sri University, India in 2015. Recently he was also recommended for “Nobel Peace Prize“by H.E Nassir Abdul-Aziz Al- Naseer, United Nations High Representative for the Alliance of Civilizations.

On receiving the award Dr. R. Seetharaman stated he would like to dedicate this award to His Excellency Sheikh Abdulla Bin Saoud Al-Thani, QCB Governor, Sh. Fahad Bin Mohammad Bin Jabor Al Thani, Chairman of Board of Directors, Doha Bank, Sh. Abdul Rehman Bin Mohammad Bin Jabor Al Thani, Managing Director, Doha Bank and other members of the Doha Bank's Board of Directors and his family for their continued support in pursuing environment friendly activities. He also gave insight on Green Banking and said, “Green Banking promotes environmental-friendly practices and reducing carbon footprint from the banking activities. The Global financial crisis has made me rethink on Green Banking. Banks as Socially responsible citizens should earmark capital for Green Banking apart from capital for regulatory requirements. The Banking environment operates within the global standards of lending or investing and such standards have been revised after the Global financial crisis both in terms of liquidity and capital adequacy. The going –concern and gone concern capital has been redefined and suitable buffers have also been developed taking into consideration the liquidity and systematic issues. However in addition to above Banks as socially responsible citizens have a role to play on protecting environment and contribute to sustainable development. Hence every Bank should earmark minimum 10% of Tier 1 capital subject to a cap of 10% of risk weighted capital towards Green banking or Clean development mechanism (CDM) or any Sustainable development projects taking into consideration the carbon emissions prevailing in the economy in which the bank operates. The Greenhouse gas (GHG) emissions need to be estimated for major economic sectors in areas of operation to determine the carbon footprint. Based on the carbon footprint in various economic sectors various initiatives be proposed to promote Green economies such as Lending for Green projects, CDM scheme and Paperless banking. The allocation matrix should be such that greater the carbon footprint in the relevant economic sector, the higher the allocation of capital for Green Banking and Sustainable projects. The carbon footprint will be different across various geographies and economic sectors and hence country wise and sector wise allocations should be explored. This forms the basis for Green banking and brings prudency into the capital framework. Green Banking is the solution for sustainable development.”

Dr. R. Seetharaman also highlighted the initiatives undertaken under his leadership as part of Green Banking by Doha Bank. He said “Doha Bank has promoted paperless banking, Internet Banking, SMS Banking, Phone Banking and ATM Banking as well as online channels such as Doha Souq, E-Remittances and Online Bill Payments. It has launched Green Credit Card and Green Account. It also has a dedicated Green Banking Website which integrates the bank’s initiatives in promoting environmental safety with the community by reaching out to both the public and private sectors. Doha Bank conducted Green Quiz with Global warming and climatic changes as a central theme to spread awareness in various countries across the Globe. Doha Bank was involved in Project financing for supporting the construction of Qatar General Electricity & Water Corporation’s Water Security Mega Reservoirs Project. It has also provided term loan for Emirates Central Cooling Systems, which provides Efficient District Cooling Services (DCS) to developments in Dubai and the surrounding region. Doha Bank has tracked the developments pertaining to various Conference of Parties (COP) meetings of United Nations Framework Convention on Climate Change (UNFCCC).”