Dovish Fed offers limited respite for EMs

Emerging Markets (EMs) have continued to suffer from capital outflows, even after the Federal Reserve (Fed) decided not to increase interest rates on 17th September (as we predicted in a previous commentary, Markets could tilt the Fed towards postponing its rate hike). All else being equal, lower US interest rates would have been expected to slow capital flows away from EMs by maintaining the interest differential between EMs and developed markets (DMs). Lower US rates should also reduce the debt burden of EM’s USD denominated debt as they should lead to a weaker USD. The fact that capital outflows have continued even with the dovish Fed, suggests that concerns about EMs are more deep-seated. Investors are also worried about structural economic weaknesses in a number of EMs, such as slowing growth, falling commodity prices and rising credit.

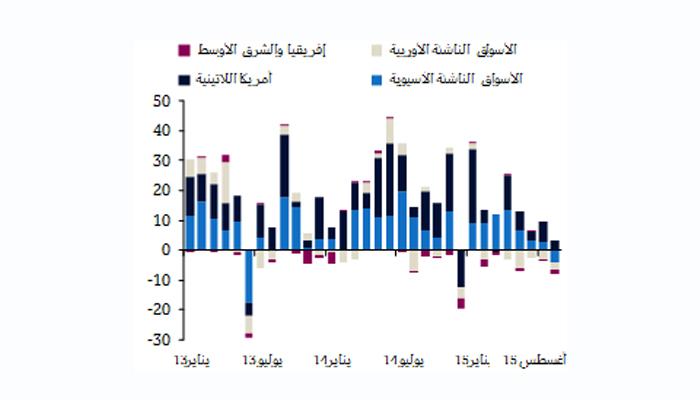

Monthly Debt and Equity Flows into EMs

(USD bn)

Sources: Institute of International Finance (IIF) and QNB Economics

Recent data on capital flows, exchange rates, equity markets and sovereign yields, all suggest that capital flight from EMs has picked up since the Fed decision not to hike on 17th September. First, the IIF produces data on daily debt and equity portfolio flows from seven EMs (Indonesia, India, Korea, Thailand, South Africa, Brazil and Turkey). Although these EMs received net inflows on the 17th and 18th of September of USD800m, suggesting some relief at the Fed decision, this amount was soon swamped by net outflows from 21st-30th September totalling USD2.9bn. Second, exchange rates in nearly all major EMs weakened significantly against the USD. During 17th-30th September, the Brazilian real fell 3.1%, the South African rand fell 4.4% and the Malaysian ringgit fell 3.7%. The notable outperformer was the Indian rupee which strengthened 1.3%, giving the Reserve Bank of India room to cut interest rates by 50 basis points (more than the 25bps expected) on 29th September. Third, equity markets in almost all EMs have fallen since the Fed’s announcement—Brazil is down 7.2%, South Africa 1.6% and Russia 5.1%. Overall, the MSCI EM equity index fell 3.7% over the period. Fourth, sovereign yields have risen in most major EMs, up 37bps in Brazil, 36bps in Turkey and 7bps in Indonesia, for example. Overall, the spread of EM bond yields over DM yields widened by 54bps as capital flowed out of EMs and into safe havens.

There are a number of structural economic reasons that capital flight from EMs has continued despite the Fed’s decision to keep rates on hold. First, EM GDP growth forecasts have been steadily revised down this year as activity has slowed. The Fed even pointed to slowing global growth as a reason for not increasing rates, which may have heightened investor concerns, especially in EMs. Second, a number of EMs are commodity based economies, which have been hit by the collapse in oil and other commodity prices since mid-2014. Countries such as Brazil, Indonesia and South Africa have all suffered from a heavy dependence on commodity exports. Third, rising corporate debt (~15% of it denominated in USD) is becoming an increasing drag on growth. EM non-financial corporate debt more than quadrupled from USD4tn in 2004 to USD18tn in 2014. The IMF recently warned that corporate defaults are likely to increase, especially if the Fed hikes rates, leading to even slower EM growth.

China is at the centre of EM woes. Incoming data on China have pointed to slower growth. The devaluation of the yuan destabilised global financial markets in August and heightened concerns about the seriousness of China’s economic problems. Slower Chinese growth means less regional demand, impacting a number of Asian EM exporters. As the world’s largest consumer of most commodities, slowing growth in China has also pushed down commodity prices, negatively impacting commodity-based EMs. Finally, China is also responsible for a large share of the increase in EM corporate debt—total bank, household and corporate credit in China has grown rapidly to reach USD21tn, or over 200% of GDP. At some point, deleveraging in China and other EMs is inevitable and is likely to drag on growth.

So with China expected to slow further and a Fed rate hike still on the horizon (widely expected in December), the outlook for EMs remains murky. Higher US interest rates will lead to tighter financial conditions in EMs, with some EM central banks likely to be forced to raise policy rates to combat capital outflows. Combined with moderating demand from China, growth is, therefore, likely to continue slowing going forward, leaving EMs vulnerable to further capital flight, weaker exchange rates and underperforming financial markets.