Emirates Integrated Telecommunications Company PJSC Reports its Q4 and full-year 2023 Results

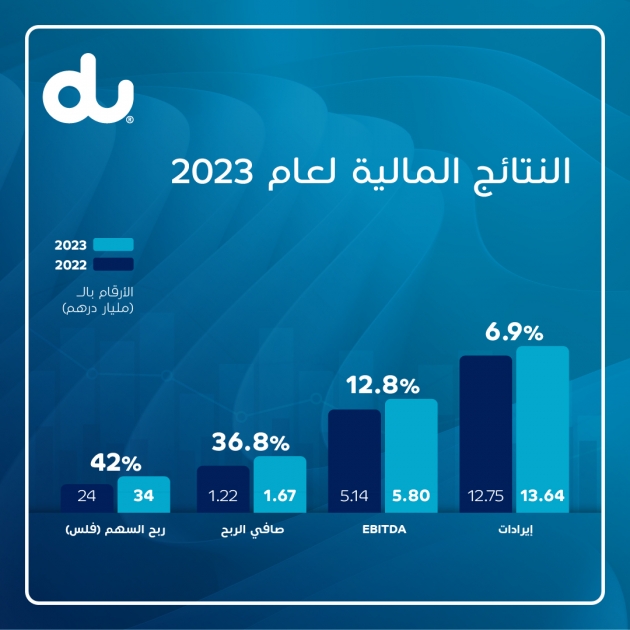

Emirates Integrated Telecommunications Company PJSC published today its financial results for Q4 and the full-year 2023. Full-year revenues grew by 6.9% to AED 13.64 billion highlighting sustained demand for mobile services, and strong growth in postpaid and fixed services. Full-year EBITDA surged 12.8% to AED 5.80 billion. This impressive performance underlines top line growth combined with margin expansion and disciplined cost management. Full-year Net Profit reached a remarkable AED 1.67 billion, a 36.8% increase year on year mainly reflecting the strong EBITDA growth. Full-year Capex was stable at AED 2.2 billion and Operating Free Cash Flow (EBITDA – Capex) for the year substantially up 23.2% to AED 3.6 billion.

On the basis of these strong results, the Board recommends increasing the full-year dividend to 34 fils per share, out of which 13 fils per share were already paid in August 2023 as an interim dividend.

2023 Operating highlights

- Our mobile customer base grew 8.3% year-over-year to 8.6 million subscribers. Strong net-additions in the last quarter (456,000) were mainly driven by significant increase in prepaid customers benefitting from seasonality and promotional campaigns. The postpaid customer base also witnessed a robust 10.5% growth year-over-year to 1.6 million (Q4 2023 net additions: 63,000) driven by our data centric plans and attractive offers.

- Our Fixed customer base rose by 12.6% year-over-year, to end the year with 604,000 subscribers, with full-year 2023 net-additions of 68,000. This robust performance was the result of ongoing commercial efforts in various product categories and the successful implementation of our broadband strategy.

2023 Financial highlights

- Revenues in Q4 2023 grew by 7.3% year-over-year to AED 3,558 million. Full-year revenues grew by 6.9% to record breaking AED 13,636 million.

- Mobile service revenues in Q4 2023 grew 5.4% year-over-year to AED 1,576 million on higher postpaid revenues. Mobile services revenues for the full-year were AED 6,105 million, a 6.2% increase year-on-year.

- Fixed services revenues remained a key component of service revenue growth albeit at a slower pace compared to 2022 which benefitted from the ramp-up of home wireless services. Q4 2023 revenues reached a new high of AED 953 million or a 4.0% year-over-year growth. Fixed service revenues for the full-year were up 8.6% to reach AED 3,774 million. The growth was mainly driven by Home Wireless and enterprise connectivity.

- “Other revenues” in Q4 23 increased by 14.0% to AED 1,029 million driven by mobile handset sales and visitor roaming. On a full-year basis, “Other revenues” grew 6.4% to reach AED 3,757 million.

- EBITDA in Q4 2023 grew 9.6% to AED 1,430 million on higher service revenues. Full-year EBITDA grew 12.8% to AED 5,800 million thanks to healthy revenue growth, expansion of gross margins and sound cost optimisation. Full-year EBITDA margin expanded by a remarkable 2.2 percentage points to 42.5%.

- Net Profit in Q4 2023 surged 38.5% to AED 396 million. Net profit for the full-year substantially up 36.8% to AED 1,668 million mainly reflecting higher EBITDA and higher finance income.

- Capex in Q4 2023 amounted to AED 759 million while full-year Capex was AED 2,198 million (2022: AED 2,220 million). Capex was focused on expansion of the 5G network (population coverage 98.5%), deployment of fibre and the transformation of the existing IT and network infrastructure. Capital intensity moderated to 16.1% (2022: 17.4%).

- Operating free cash flow (EBITDA – Capex) in Q4 remained stable at AED 672 million. Full-year Operating free cash flow increased by 23.2% to AED 3,602 million, underscoring the company’s strong cash flow generating capabilities.

Financial summary

| AED million | Q4 2022 | Q4 2023 | change | 2022 | 2023 | change |

| Revenues | 3,315 | 3,558 | 7.3% | 12,754 | 13,636 | 6.9% |

| EBITDA | 1,305 | 1,430 | 9.6% | 5,143 | 5,800 | 12.8% |

| Margin | 39.4% | 40.2% | +0.8 pts | 40.3% | 42.5% | +2.2 pts |

| Net profit | 286 | 396 | 38.5% | 1,220 | 1,668 | 36.8% |

|

|

| ||||

| Capex | -633 | -759 | 19.9% | -2,220 | -2,198 | 1.0% |

| capital intensity | 19.1% | 21.3% | -2.2 pts | 17.4% | 16.1% | -1.3 pts |

| Operating free cash flow | 671 | 672 | 0.0% | 2,925 | 3,602 | 23.2% |

| Margin | 20.3% | 18.9% | +1.4 pts | 22.9% | 26.4% | +3.5 pts |

|

|

Malek Sultan Al Malek, Chairman, commented

“In 2023, Emirates Integrated Telecommunications Company stayed committed to its objective of driving positive changes in the digital and technological arena within the UAE. This commitment is in line with our commitment to support the country's strategic plans, comply with the directives of our wise leadership, and align with their vision for a more prosperous future built on knowledge and innovation. Additionally, we provided extensive support for government initiatives and policies aimed at accelerating economic and social development, empowering business communities, and enhancing the quality of life for the residents of UAE. The robust macroeconomic environment and our strong commercial momentum has enabled us to achieve significant milestones and excellent financial results

We saw a significant evolution of our business model in 2023, sharpening our strategic focus. This focus has delivered record revenues of AED 13.6 billion, net profit of AED 1.67 billion and generated an operating free cash flow of over AED 3.6 billion. Our business remains highly cash generative while sustaining investments in our future growth and our balance sheet remains unleveraged and solid with AED 5.7 billion in available liquidity.

I am pleased to announce that, on the basis of these strong results, the Board is recommending to increase the full-year dividend to 34 fils per share, out of which 13 fils per share were already paid in August 2023 as an interim dividend. This corresponds to a 41.7% increase and a distribution of 100% of net profits after appropriation for statutory reserves.”

Fahad Al Hassawi, CEO said:

“2023 has been a transformational year for du. Our relentless determination and focus have enabled us to deliver on our current strategy while laying out a solid foundation for future growth in both our core business and beyond.

We achieved significant operational milestones including expansion of our 5G to 98.5% population coverage, increased digitalisation of our customer touch-points with over 75% of our customer interactions moving online and growing our strategic partnerships with key institutions in the UAE. Our technological and digital transformation journey is enhancing customer experience and we have made considerable progress towards building our abilities in fintech. Our product offerings continue to be innovative, winning multiple industry awards. This was made possible first and foremost by the commitment to excellence of our people.

This year, du delivered a historic financial performance, posting the highest revenues, gross margin and EBITDA in our company’s history driven by a strong performance in our core business combined with accelerating growth in our new business ventures and continued focus on operating efficiency and disciplined cost management. We continued investing in our future growth, with AED 2.2 billion Capex in 2023 deployed in our core infrastructure and IT, underscoring our commitment to digital transformation.

In 2024 we aim to execute our strategy and continue building upon our strong financial performance, reinforcing our leadership in our core business through a differentiated digital-first approach, leveraging our platform for disruptive customer-centric innovation, and harnessing structural efficiencies across our operations while expanding our new business venture and enhancing our customer experience.”

ENDS