Agility’s Earning Release for Full Year 2014

Agility’s Financial Results for full year and Q4 2014

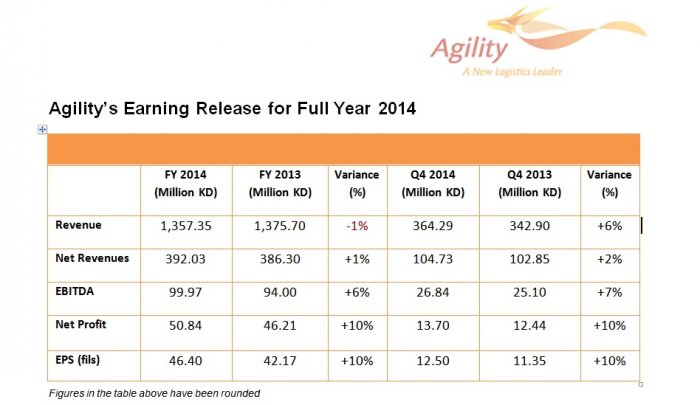

Agility today announced its full-year 2014 financial results, reporting a net profit of KD 50.84 million, or 46.40 fils per share, an increase of 10% over the same period in 2013. Revenues for the year stand at KD 1.36 billion. EBITDA stands at KD 99.97 million, a 6% increase compared to FY 2013.

For the last quarter of 2014, Agility reported a net profit of KD 13.70 million with an earnings-per-share of 12.50 fils, an increase of 10% over the same period in 2013. Revenue for the quarter stands at KD 364.29 million, a 6% increase when compared to the Q4 of 2013. EBITDA also saw a 7% increase compared with Q4 of last year, and stands at KD 26.84 million.

The board has met and proposed a dividends distribution of 35% (35 fils per share) and 5% bonus shares for the fiscal year 2014.

“Agility has steadily grown bottom-line profitability across its various business entities over the last three years. Agility will continue to drive margin expansion in its Global Integrated Logistics business by focusing on strengthening its operating platform, maintaining financial discipline, and focusing on high-growth markets, products, and verticals. We will also continue to grow our Infrastructure portfolio of companies, which are uniquely positioned to capture opportunities in niche segments in emerging markets. A key part of this growth will include accelerating our expansion on the African continent,” said Tarek Sultan, Agility’s Vice Chairman and CEO.

Agility’s Global Integrated Logistics (GIL)

GIL revenue for the full year of 2014 was KD 1 .06 billion, a 6% decline from the same period last year. This reflects both general economic volatility and the winding down of major project logistics contracts held by Agility in countries like Australia and Papua New Guinea.

That said, GIL’s net revenue has improved by 1% in 2014. Margins have expanded from 21.8% in 2013 to 23.4% in 2014. This is attributed primarily to two factors. First, continued growth in contract logistics across the Middle East and Asia, where Agility opened new facilities, improved warehouse occupancy, and grew volumes from existing and new customers. Second, Agility’s air freight yields improved in 2014, offsetting some of the continued margin pressure on the ocean freight side.

Agility Global Integrated Logistics will continue to focus on three areas:

- Commercial excellence through a strong trade lane management approach and focus on high-growth markets and industries

- Operational excellence by transforming its business through technology.

- Financial discipline to ensure its cost structure remains lean and flexible.

Agility’s Infrastructure Group

In 2014, Agility’s Infrastructure group of companies saw revenues increase by 18% to KD 302.90 million, when compared with the full year of 2013.

Revenues for Agility’s real estate business grew by 12% compared to the same period this year. Agility maintains a strong real estate platform in Kuwait, but is also actively developing holdings in other Gulf countries, the subcontinent, and Africa. In 2014, Agility broke ground on an Agility Distribution Park in Ghana, the first of a series of logistics hubs across the African continent that will provide international-standard logistics infrastructure to local, regional and global companies.

“Agility’s Infrastructure companies have historically performed well, and this year was no exception. We continue to believe in the long-term opportunities that the Infrastructure companies have to tap into niche segments in emerging markets across the Middle East, Asia, and Africa,” said Sultan. “We add value to our customers by being willing to go in early, investing in infrastructure that enables trade, building local capacity, and continuing to deliver even through the tough times.”

Africa is an area of focus for Agility’s businesses across the board. Global Integrated Logistics has operational capacity in 11 Africa countries and is planning to expand further, and our Project Logistics division has long-solved complex supply chain challenges for the oil and gas industry in West Africa. In addition, in 2014, National Aviation Services expanded its ground handling footprint on the continent with a new concession in the Ivory Coast. Tristar, a fuel logistics company, owns and operates more than 30 terminals in Africa with more than 60 million litres in storage capacity. Agility recently opened new business development offices in Mozambique and Ghana with a view to offering truly integrated solutions across its various lines of business.

Recap of Financial Performance for the year of 2014

• Agility’s net profit stands at KD 50.84 million, a 10% increase from KD 46.21 million in 2013. EPS was 46.40 fils, compared to 42.17 fils a year earlier.

• EBITDA stands at KD 99.97 million, a 6% increase from the same period a year before.

• Agility’s revenues for the full year of 2014 stand at KD 1.36 billion, a decrease of 1% from KD 1.38 billion in the same period in 2013. Agility’s net revenues increased by 1% from the same period.

• GIL’s revenue stands at KD 1.06 billion a 6% decrease from the same period a year earlier.

• Infrastructure’s revenue is KD 302.90 million compared with KD 257.24 million in 2013, an 18% increase from 2013.

• Agility enjoys a healthy balance sheet with a net cash position of KD 60 million as of 31st December 2014 and free-cash-flow of KD 24.7 million for the full year of 2014.

“Agility has grown steadily for the last few years. We will continue to maintain discipline and focus on execution in our core logistics business, but at the same time are also investing for the future on the Infrastructure side. As always, we remain committed to delivering value for our shareholders and engaging responsibly with our communities. We would like thank our shareholders, stakeholders and employees for their continuous support,” Sultan said.

About Agility

Agility brings efficiency to supply chains in some of the globe’s most challenging environments, offering unmatched personal service, a global footprint and customized capabilities in developed and developing economies alike.

Agility is one of the world’s leading providers of integrated logistics. It is a publicly traded company with more than $4.8 billion in revenue and more than 20,000 employees in over 500 offices across 100 countries.

Agility’s core commercial business, Global Integrated Logistics (GIL), provides supply chain solutions to meet traditional and complex customer needs. GIL offers air, ocean and road freight forwarding, warehousing, distribution, and specialized services in project logistics, fairs and events, and chemicals.

Agility’s Infrastructure group of companies manages industrial real estate and offers logistics-related services, including e-government customs optimization and consulting, waste management and recycling, aviation and ground-handling services, support to governments and ministries of defense, remote infrastructure and life support.

For more information about Agility, visit Agility.com

Twitter: twitter.com/agility

LinkedIn: linkedin.com/company/agility

YouTube: youtube.com/user/agilitycorp

Or contact us at investor@agility.com

Share:

ADD TO EYE OF Riyadh

MOST POPULAR

RIT Dubai launches Bachelor of Science in Advertising and Public Relations

Tuesday 17 February, 2026 9:05Saudi Arabia, Qatar ink maritime, logistics MoU

Wednesday 18 February, 2026 1:16stc group Achieves Record-High Revenues of SAR 77.8 Billion and Net Profit Growth of 12.5% After Excluding Non-Recurring Items

Wednesday 18 February, 2026 12:17Red Sea unit signs SAR 175.9M contract

Wednesday 18 February, 2026 12:11Jabal Omar receives white land fees invoices of SAR 31M

Wednesday 18 February, 2026 12:13 ×